In this blog post, discover how investing in early childhood education not only addresses the persistent issue of preschool waitlist times but also offers a lucrative and socially impactful opportunity for investors.

The Ultimate Guide to Investing in Early Childhood Education Real Estate

Discover the trends, strategies, and opportunities for preschool development and how you can make a thriving investment.

In this comprehensive guide, we delve into the world of early childhood education real estate, offering our insights into trends, strategies, and investment opportunities for preschool development. From understanding the importance of ECE to navigating the complexities of investing in this dynamic sector, this guide equips investors with the knowledge needed to make informed decisions and capitalize on the growing demand for high-quality preschool facilities.

- What is Early Childhood Education?

- What is Early Childhood Education Real Estate?

- Why Should You Invest in Early Childhood Education Real Estate?

- When is the Right Time to Invest in ECE?

- Where Should You Invest in ECE?

- How Can You Invest in ECE?

What is Early Childhood Education?

Early childhood education (ECE) focuses on teaching children from birth to approximately eight years old, typically up to the equivalent of third grade. (In this guide, we will focus primarily on ECE in the context of nursery care and preschool education, or ages zero to five.) The ECE sector plays a vital role in preparing young children for academic achievement and social development, laying the foundation for lifelong learning and success. With increasing recognition of the importance of early education, the demand for high-quality preschool programs has surged in recent years.

Types of Early Childhood Education Programs:

ECE programs can vary in their structure, operations, and curriculum. We have outlined some of the most common types of early childhood education below:

- Private preschools and daycares operate independently and may offer specialized programs or amenities at a premium price point.

- Corporately-operated locations are typically operated directly by a single entity or organization, offering greater control over curriculum, staffing, and quality assurance.

- Franchised locations, on the other hand, operate under the umbrella of a larger brand, following standardized procedures and curriculum but with varying degrees of autonomy.

- Public or subsidized preschools and daycares may receive funding from government sources or community organizations, aiming to provide affordable early education opportunities to families in need.

- Home education, including homeschooling and informal caregiver-led learning, is also a significant component of ECE, offering personalized instruction within a home environment.

Early Childhood Education Curriculum and Accreditation

The curriculum and accreditation of early childhood education programs are paramount in ensuring quality and effectiveness. Various curriculum models exist, ranging from play-based and Montessori to academic-focused approaches such as STEAM (science, technology, engineering, arts and mathematics). ECE programs can also be recognized for certain accreditation statuses, signifying adherence to high standards of educational excellence, safety, and child development principles.

The Learning Zone is a prime example of a privately owned, corporately operated, award-winning preschool that sets the bar for excellence in early childhood education. With a research-based curriculum and a family-oriented approach, they are redefining preschool education standards. (You can learn more about our partnership and investment opportunities with TLZ here.)

What is Early Childhood Education Real Estate?

For the purposes of this guide, we will be looking specifically at the early childhood education real estate sector and the opportunity it presents for financial investment. ECE real estate involves the acquisition, construction, and management of properties specifically designed to accommodate preschool programs and childcare services. These facilities are purpose-built to meet the unique needs of young children, offering safe, stimulating environments conducive to learning and growth.

The development process for ECE facilities typically involves site selection, zoning approvals, design, construction, and ongoing management. Each stage requires careful consideration of factors such as location demographics, regulatory requirements, facility layout, and safety standards to ensure the successful establishment and operation of the preschool. By aligning with reputable developers and operators, such as CMK Properties, investors can play a pivotal role in shaping the future of early childhood education while also realizing financial returns.

Why Should You Invest in Early Childhood Education Real Estate?

The early childhood education (ECE) industry stands as a beacon of opportunity for investors seeking stable, resilient, and profitable ventures. In recent years, the demand for reliable childcare services has surged, driven by an increasing number of parents entering the workforce, a rise in single-parent households, and a growing youth population. This escalating need underscores a steadfast and burgeoning market for high-quality preschool facilities.

Below, explore what we believe are the top reasons to consider an investment in early childhood education real estate.

1. Demand Metrics for Early Childhood Education

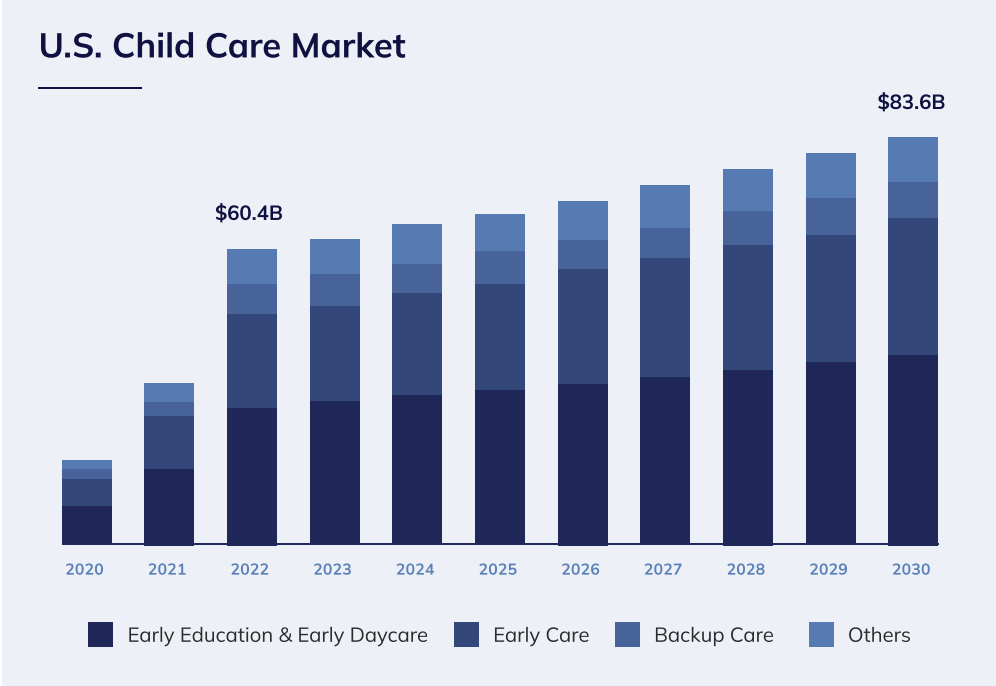

The ECE industry is a significant economic force, valued at $60.4 billion, with a compound annual growth rate projected at 4.18% through 2030. Notably, 64% of children between the ages of 3-5 are enrolled in preschool, and, with 67% of families spending more than 20% of their income on childcare, the financial commitment required underscores the value parents place on quality preschool education.

Despite the high demand, there exists a critical gap of over 3.6 million children in the US who lack access to adequate childcare options. Coupled with a rising average waitlist time for preschools (oftentimes surpassing a year long in high-growth markets such as Nashville), real estate sponsors are presented with a timely opportunity to develop new childcare facilities.

2. Strong, Risk-Mitigated Leases in Preschools

The majority of privately-owned preschools are protected by favorable lease terms, offering consistent cash flow, inflation protection, and credit enhancement to investors. Triple net leases, structured where tenants are responsible for most costs, are common in the industry, in addition to long-term lease agreements with rent escalations over time.

Lease guarantees further mitigate risks and ensure a stable income stream for investors. CMK’s operator, in particular, secures all facilities with both corporate and personal guarantees, meaning the lease is backed by the assets of the owner and the parent company, providing full assurance that rent will be paid for the full length of the lease.

3. Investing in ECE Real Estate Compared to Other Sectors

Early childhood education offers a relatively risk-mitigated opportunity with high cash-flow potential, ideal for investors seeking consistent passive returns. Some ECE investments can provide up to 8% annual preferred returns and a nearly 20% overall internal rate of return (IRR), outperforming traditional investment options such as REITs and bonds. Even within real estate, ECE has been known to outperform other sectors.

Investing in real estate as opposed to the stock market also introduces a variety of potential tax advantages, including depreciation deductions. Considering this, more traditional investors should be careful not to overlook ECE investments for the diversification and advantages they can offer to a portfolio.

4. Benefits of Investing in Early Childhood Education

As we’ve mentioned, investing in ECE real estate offers numerous benefits to investors, including strong cash flow from rents, tax advantages, and higher returns compared to traditional investment options. Furthermore, the high-growth nature of the industry provides opportunities for investors to be part of a thriving sector.

But the benefits extend beyond financial measures. From a social perspective, investing in early childhood education allows investors to contribute to the development of children and support the next generation’s educational journey. For socially-conscious investors, or those with a passion for education, this may be a particularly appealing investment sector.

When Is the Right Time to Invest in ECE Real Estate?

Early childhood education facilities have often been overlooked by investors and real estate investment firms in the past. However, the COVID-19 pandemic has reinforced how essential these centers are, as most preschools are not only meeting but even surpassing pre-COVID enrollment numbers.

The demand for convenient and high-quality child care, especially from working parents, is nothing new. A study published by Ready Nation, Council for a Strong America in February 2023, revealed that nearly two-thirds of parents of infants and toddlers reported being late for work or leaving work early due to childcare struggles. More than half reported being distracted at work or missing full days.

The need for these facilities to support families in our community is apparent. But why is now considered the right time to invest? As with any investment, a comprehensive understanding of market conditions, economic indicators, and growth projections is essential for success in the ECE sector. Below, we outline key considerations that should be evaluated when asking the question: Is it the right time to invest in ECE?

1. Market Conditions

Market conditions play a crucial role in determining the demand for early childhood education services. Various factors influence this demand, including population demographics, local birth rates, parental preferences, and the availability of quality childcare options in the area. Take, for instance, Huntsville, Alabama, one of CMK Properties’ site locations. Within a 15-minute drive time from the site, there are approximately 12,766 children under the age of 6. Such demographic insights provide valuable information for understanding and catering to the demand of a given area.

2. Economic Indicators

The transaction volume for the early education sector in 2022 exceeded $681 million, up approximately $54 million over 2021. Both 2021 and 2022 nearly doubled the sales volumes of previous years, indicating a growing interest from buyers in this space.

Monitoring economic indicators is crucial for assessing the overall health of a community’s economy and its potential impact on the ECE market. Key factors considered include employment rates, average household income levels and net worth. As an example, the site location mentioned above in Huntsville, the average household income is $129,565 (Esri), and the average net worth is $1,296,950 (Esri). These indicators provide valuable insights into the local economic landscape, aiding in strategic decision-making regarding ECE services.

3. Projections of Growth

Growth projections play an important role in guiding investors to align their investment strategies with long-term trends in the evolving ECE market. The stability of the childcare sector is evident through consistent enrollment growth and significant waitlists in urban areas, highlighting its strength and potential for continual expansion. ECE demonstrates stability against economic downturns and market disruptions, particularly as families prioritize dual incomes, reaffirming its recession-resistant nature.

While the ECE industry has not been as well-known as some other single-tenant net lease sectors, it’s undeniable that this sector has gained traction over the years, becoming widely acknowledged as a secure and reliable investment.

Where Should You Invest in ECE?

Investing in early childhood education presents an exciting opportunity, especially in cities like Nashville, TN and Huntsville, AL, where daycare waitlists can extend beyond the imagination — some facilities even reporting a three-year wait, as noted by the Nashville Scene.

But where should you direct your investments in this thriving sector? Let’s dive into the factors that can make or break your ECE venture.

Factors Influencing ECE Investment Decisions:

- Population Density: Investors should prioritize areas with dense populations of families with young children. Higher demand for ECE services often correlates with a higher concentration of young families.

- Income Levels: Analyzing the income levels of a community is crucial. Investing in areas with higher household incomes suggests that families have more financial resources to allocate towards quality ECE programs.

- Education Levels: Consider the educational attainment of residents in a given area. Higher levels of education typically indicate a greater awareness of the importance of early childhood development and education.

- Employment Opportunities: Assess the job market and employment opportunities in the vicinity. Stable employment rates and opportunities for working parents suggest a higher demand for childcare services.

- Competition: Research existing ECE providers in the area to understand the level of competition. Investing in areas with underserved or growing demand for ECE services can offer better opportunities for success.

Advantages of Investing in Affluent Areas for ECE:

- Stable Enrollment: Families in affluent areas tend to have more stable lifestyles and finances, leading to more consistent enrollment in ECE programs. This stability reduces the risk of fluctuating revenues for investors.

- Long-Term Returns: Investing in ECE facilities in affluent areas can offer long-term returns as the demand for quality education and childcare remains high in such areas, ensuring continued profitability and growth potential.

- Higher Tuition Rates: Affluent areas often have a population willing and able to pay higher tuition rates for quality ECE services. This allows for potentially higher profit margins for investors or operators of ECE facilities.

Two High-Growth Markets for ECE Investment

Two cities that meet the criteria mentioned above and present promising opportunities for investing in ECE facilities are Nashville, TN, and Huntsville, AL.

Nashville, known as the top market for real estate investment, had a metro population of 2 million and a GDP of $188 billion in 2022. Located in Middle Tennessee, Nashville is part of one of the nation’s fastest-growing regions, driven by industries such as tourism, entertainment, technology, and healthcare.

Likewise, Huntsville was recently ranked the number one best place to live in the United States, with a metro population of 515,000. It also ranks among the top 30 fastest-growing metros. Its consistent population growth and excellent quality of life make it an attractive destination for ECE investment.

How Can You Invest in ECE?

Before choosing to invest in an early childhood education facility, it’s crucial to conduct thorough due diligence on the opportunity. At CMK Properties, we take specific steps in reviewing our ECE opportunities, including financial analysis, site visits, and operator evaluation. Our development approach aims to mitigate construction-related risks and generate strong, risk-adjusted returns for investors by following a methodical, repeatable process. Our Pre-Development Checklist includes data-driven site selection, due diligence, entitlements, and lease execution to ensure timely development and fundraising.

If you’re an accredited investor who values the strong investment fundamentals we’ve outlined in this guide, you’re likely contemplating how to leverage these favorable conditions.

Here are two avenues to consider:

1. Direct Ownership or Purchase of a Facility

Investors have the option to directly own or purchase a facility that caters to early childhood education. This approach allows for hands-on management and control over the property. It can be appealing for those who prefer direct involvement in the operation and development of the facility. However, it also requires significant initial investment and ongoing management responsibilities. CMK offers direct ownership options for family offices that do have the financial resources and want to invest outside of the fund strategy. Contact us for more information.

2. Investing in a Fund

Another way to invest in ECE is through a fund. This involves pooling resources with other investors to invest in a larger operator or tenant in the early childhood education sector. Investment minimums will vary by firm but can be as low as $50K, offering a more feasible opportunity than the direct, independent purchase of a facility. Investing in a fund provides diversification benefits and the opportunity to access a professionally managed portfolio of ECE assets.

If you’re interested in learning more about investing in an ECE fund, please click here.

About CMK Properties

At CMK Properties, we are actively responding to the increasing demand for high-quality early childhood education services by developing premier, privately-owned preschool facilities in affluent and growing markets. By partnering with our firm, accredited investors can access these investment opportunities and potentially capitalize on the strong demand for early childhood education facilities.

The CMK Properties portfolio spans 20 states and continues to grow, as we establish ourselves as a leading real estate development firm in Middle Tennessee. Since our establishment in 2011, we have prioritized offering solid, stable and predictable investments. With over $102 million in ongoing projects, $61 million in successful completions, and a project history exceeding $163 million, we have maintained a commitment to excellence.

If you’re interested in exploring ECE investment opportunities and learning more about CMK Properties, reach out to us through our website today.